Hello from The Arc NW!

When facilitating financial workshops, I am frequently asked “How can I budget on a fixed income.” Well, anybody with income can create a budget (aka Spending Plan). Actually, you can also create a budget based on anticipated income. This is called an Anticipatory Spending Plan or Budget. I’ll discuss the Anticipatory Spending Plan in a future post.

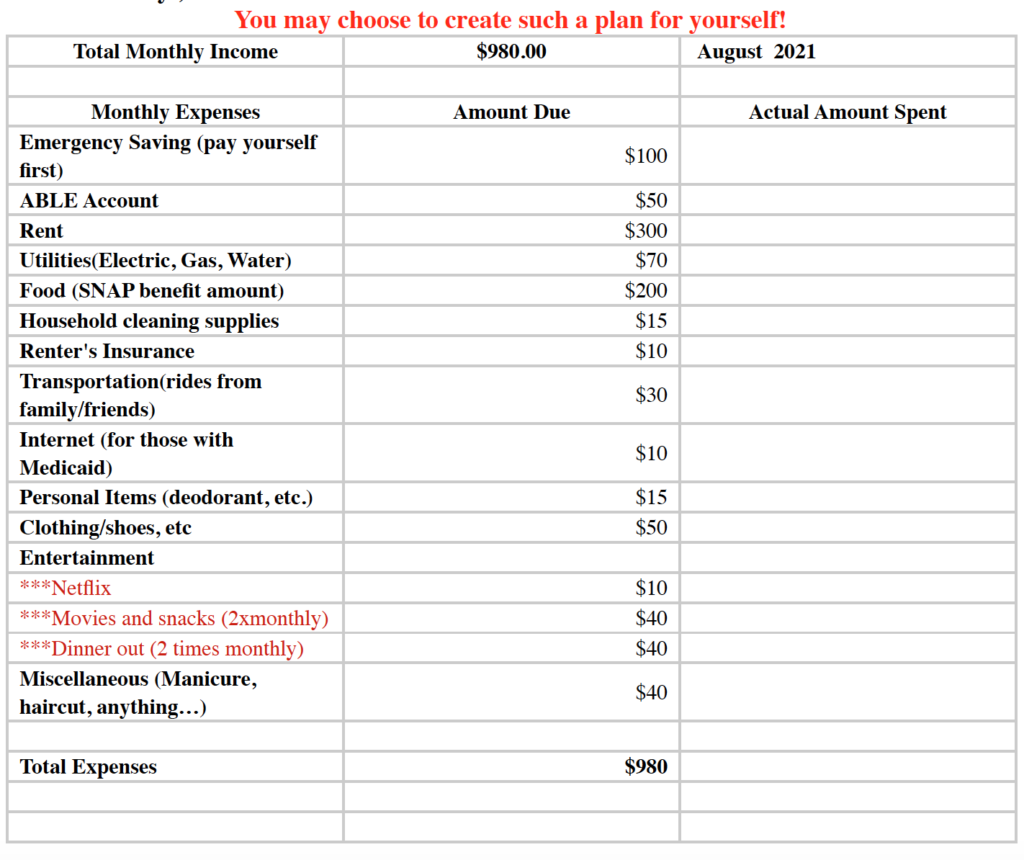

Below is a Spending Plan based on Social Security (SS) benefits (considered Fixed Income) and it is a Zero-Based Spending Plan meaning that every single dollar of your SS benefits is accounted for in your plan. Your expenses and $ amount may vary. If you have more expenses than income, you can either cut back on expenses so you can at least have enough money to pay for the things you need, increase your income, or both. Remember, there are asset limits for Social Security, Medicaid, and SNAP.

****The next workshop Financial Safety is scheduled for Tuesday, August 24, 2021, at 6:00 pm. Please feel free to contact me to register for the next workshop. We would enjoy having you join us!

Stay tuned…. Be safe…. and…Be empowered.

Bettie Cunningham, LBSW

Disabilities Advocate/Certified Financial Coach/Counselor

Office: (313) 532-7915, ext. 204 Email: bcunningham@thearcnw.org